Avalon Acquisition Inc. Stockholders Approve Proposed Business Combination Transaction with The Beneficient Company Group, L.P.

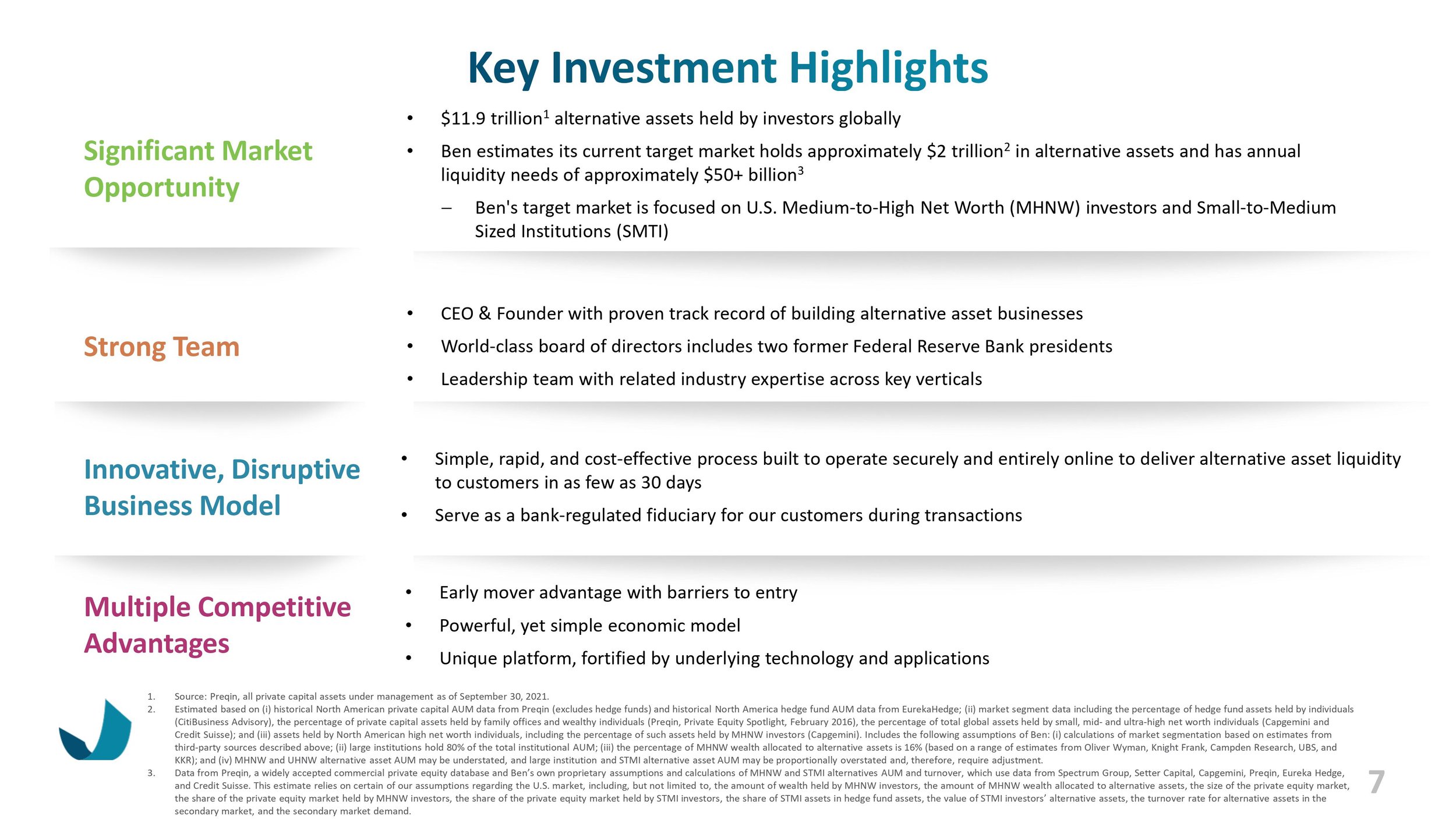

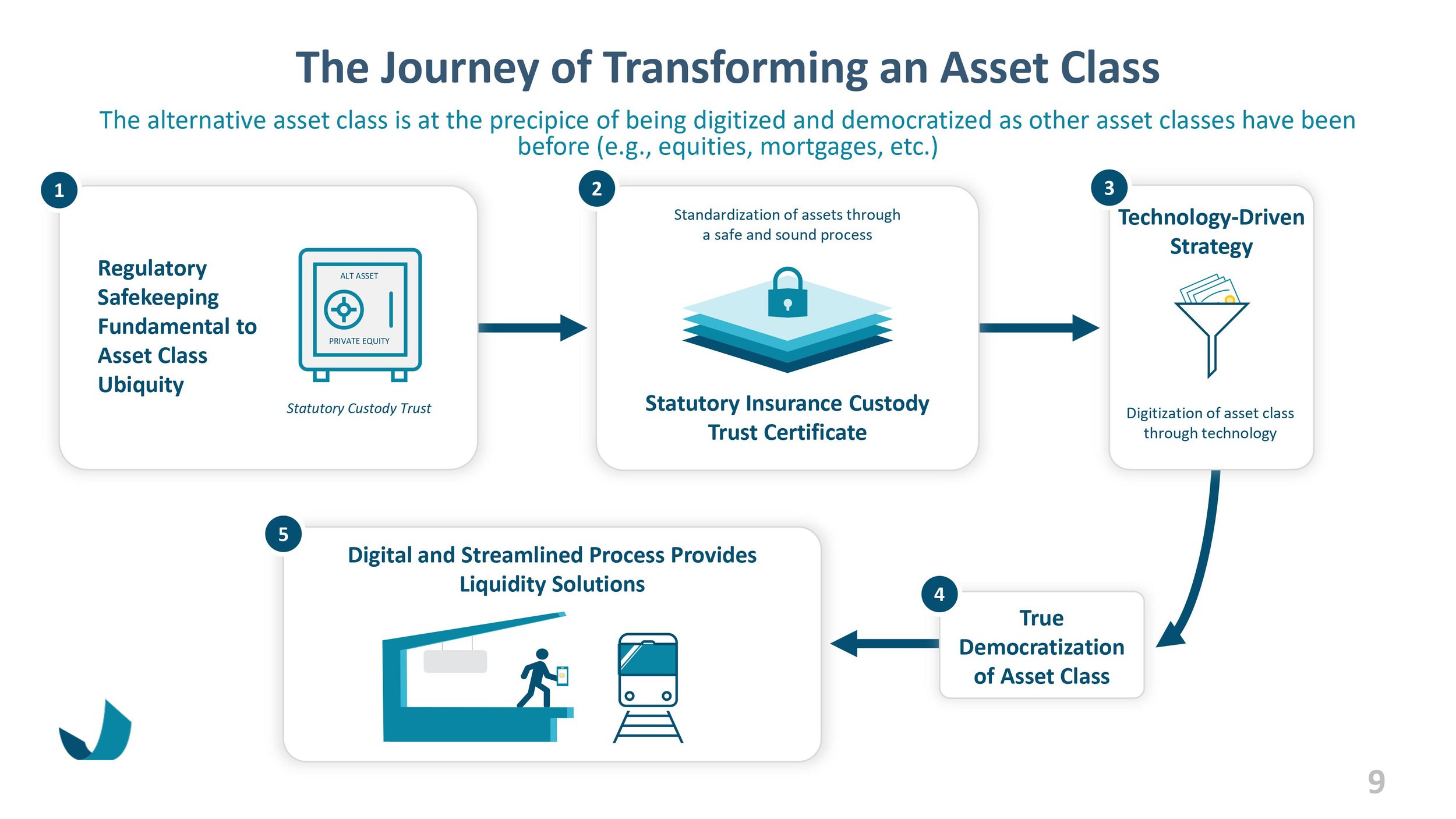

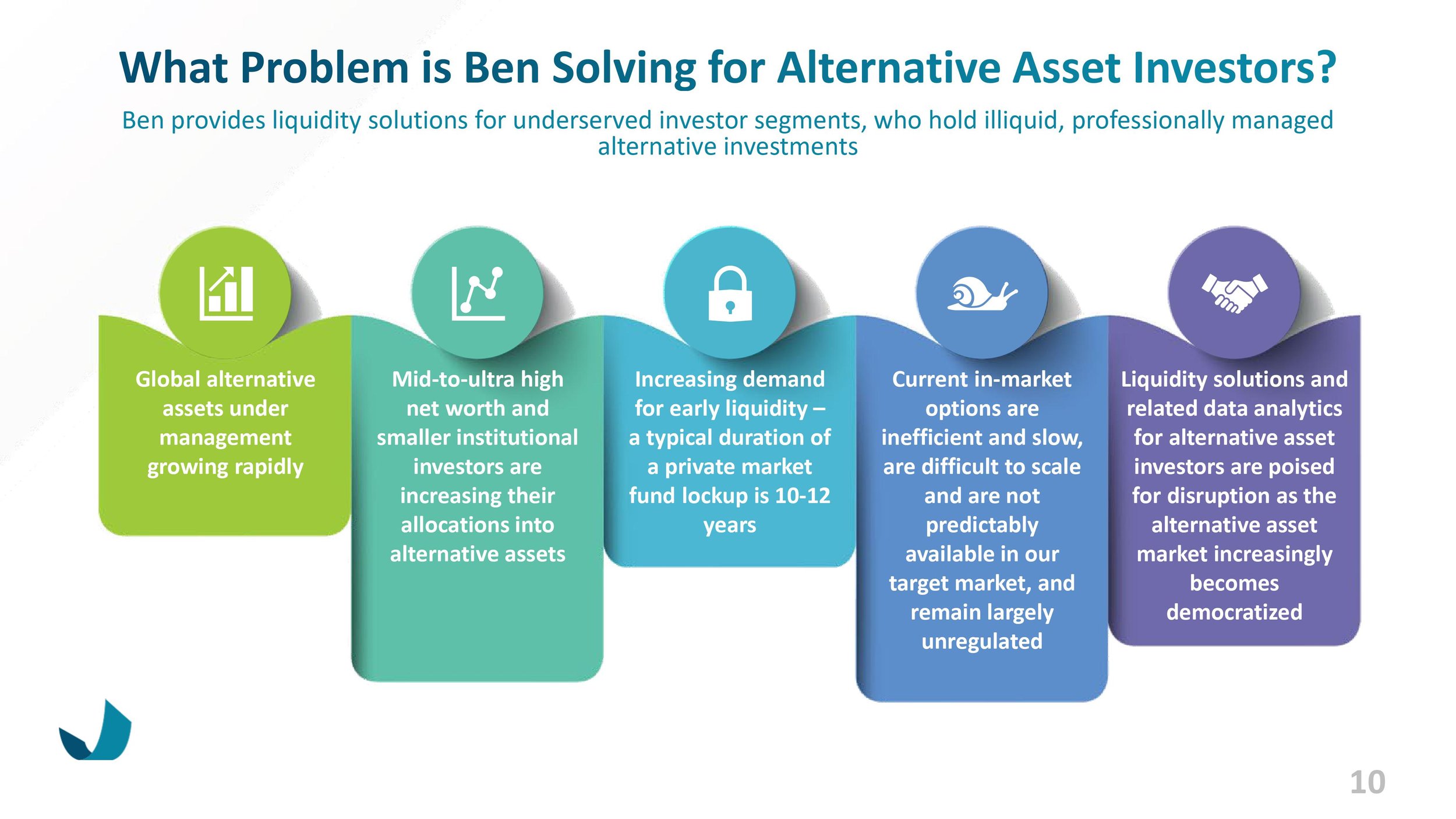

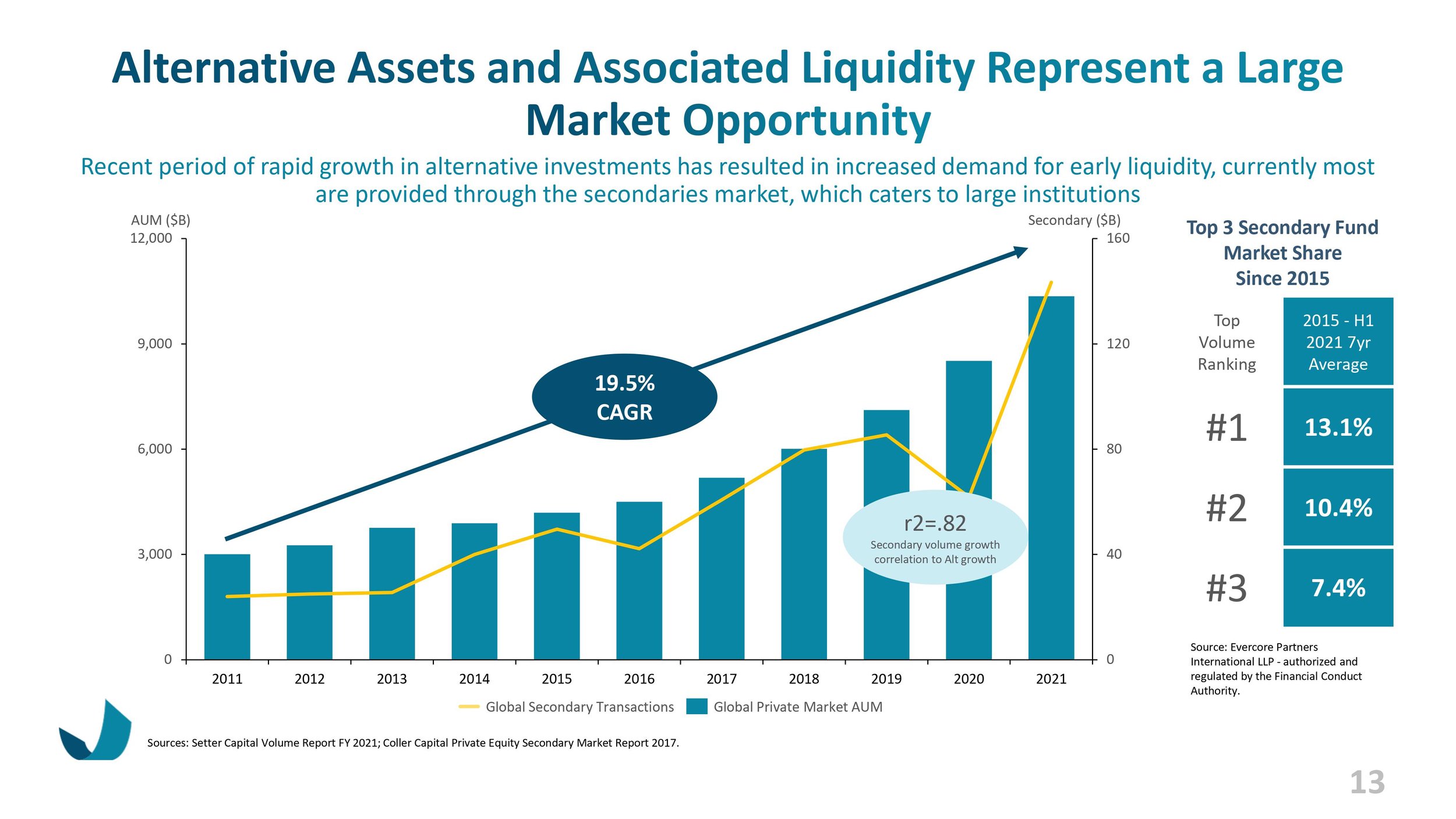

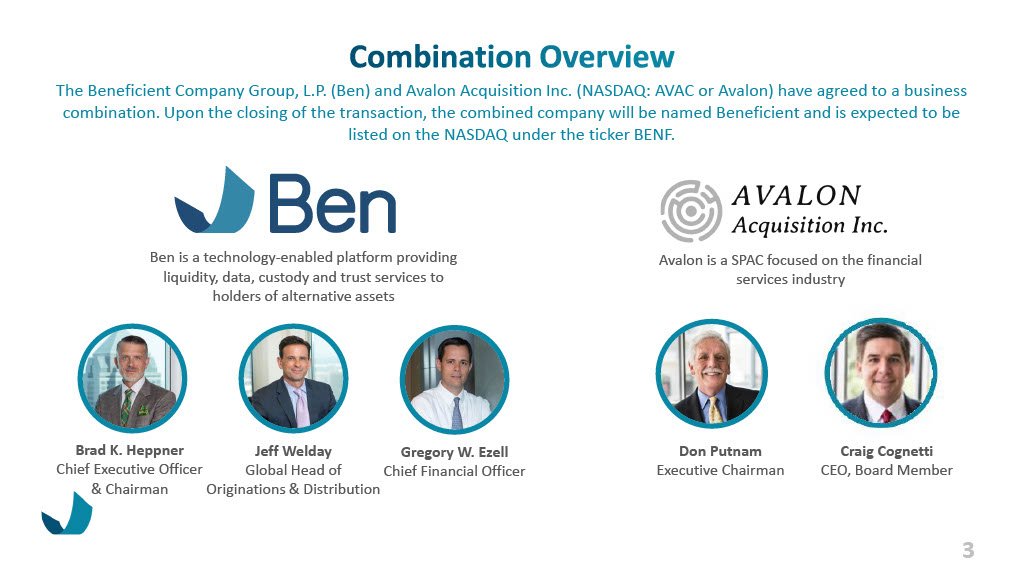

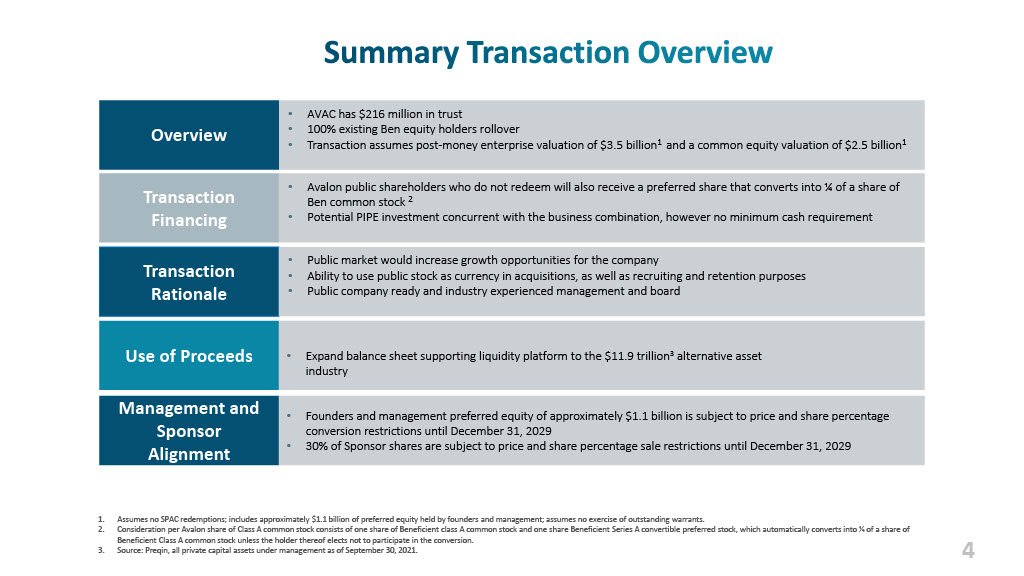

Avalon Acquisition Inc. (NASDAQ: AVAC or “Avalon”), a publicly traded special purpose acquisition company, announced that at a stockholder special meeting held on June 6, 2023, Avalon’s stockholders voted to approve its proposed business combination with The Beneficient Company Group, L.P. (“Beneficient” or the “Company”), a technology-enabled platform providing liquidity, data, custody and trust services to holders of alternative assets.

At the special meeting, Avalon common stockholders voted to approve the business combination.

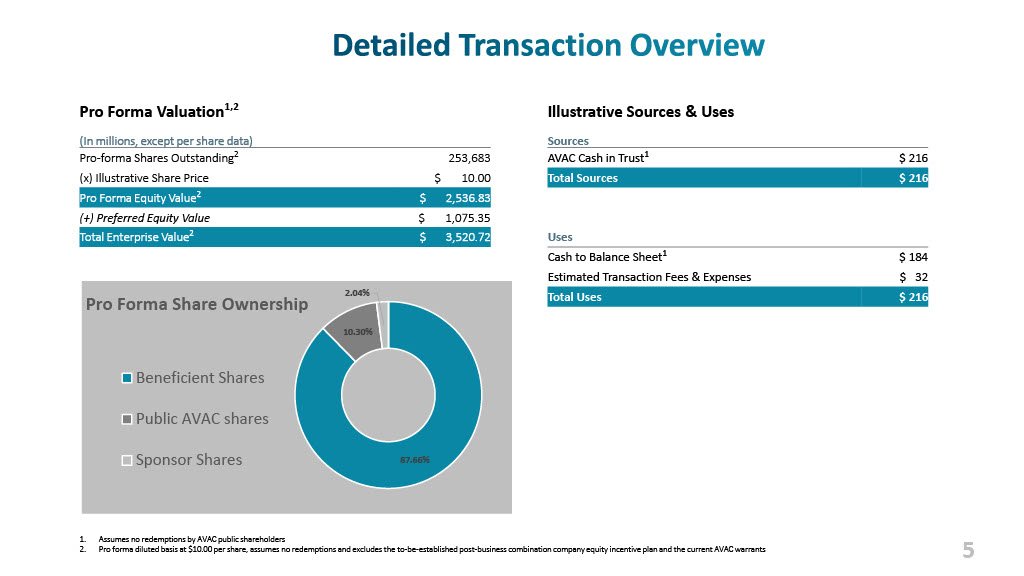

Pursuant to the business combination agreement, each share of Avalon Class A common stock, par value $0.0001 (the “Avalon Class A common stock”), converts into one share of Beneficient Class A common stock, par value $0.001 (the “Beneficient Class A common stock”), and one share of Beneficient Convertible Series A preferred stock, par value $0.001 (the “Beneficient Series A preferred stock”), which is convertible into one-quarter (1/4) of a share of Beneficient Class A common stock. As the Beneficient Series A preferred stock is not expected to be listed on The Nasdaq Stock Market LLC (“Nasdaq”), the Beneficient Series A preferred stock would automatically and immediately upon issuance convert into shares of Beneficient Class A common stock, which is expected to result in an effective exchange ratio of 1.25 shares of Beneficient Class A common stock for every one share of Avalon Class A common stock.

The business combination is expected to close on June 7, 2023, and the combined company’s common stock and warrants are expected to begin trading on Nasdaq on June 8, 2023, under the new ticker symbols “BENF” and “BENFW,” respectively.

About Beneficient

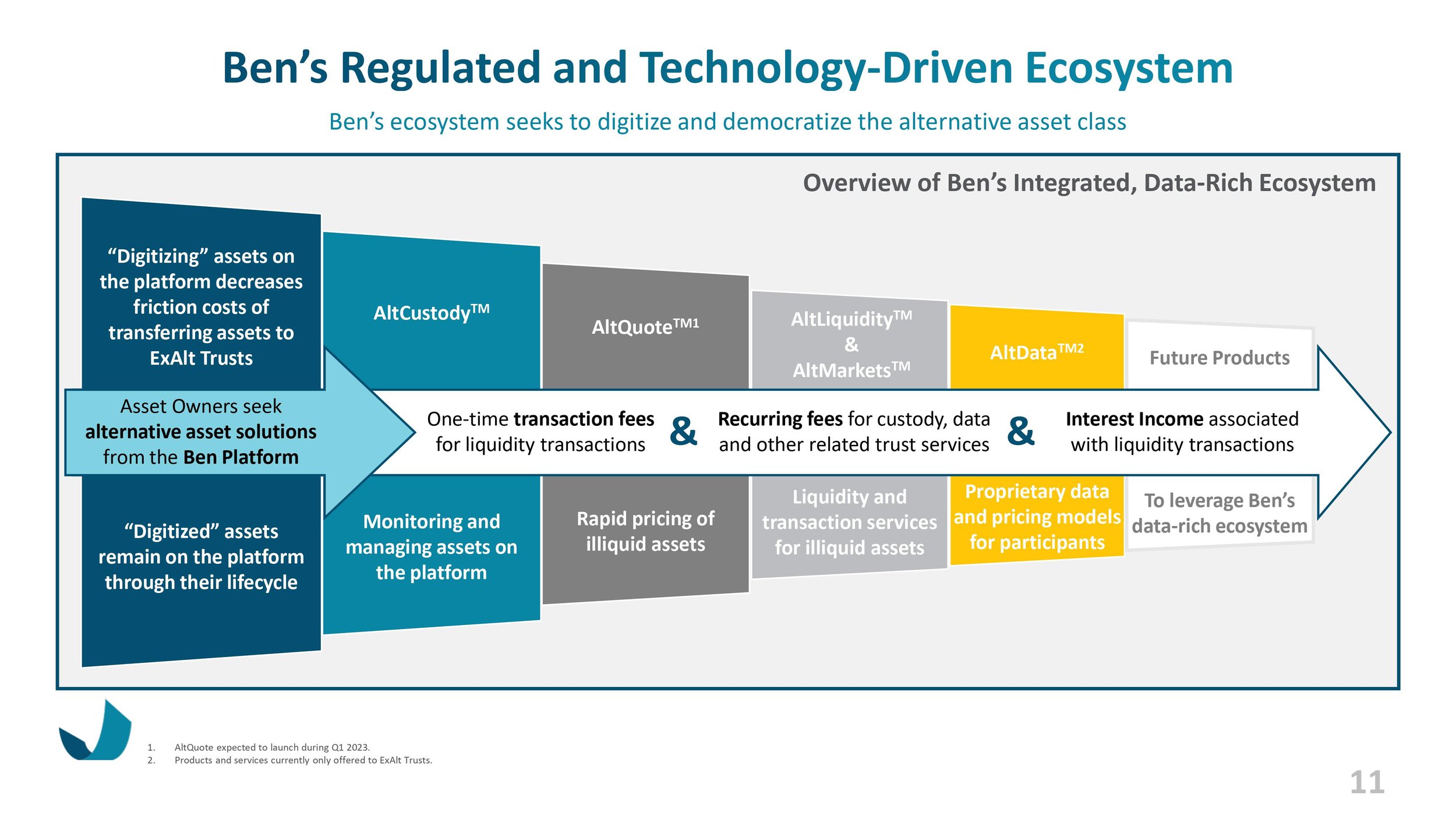

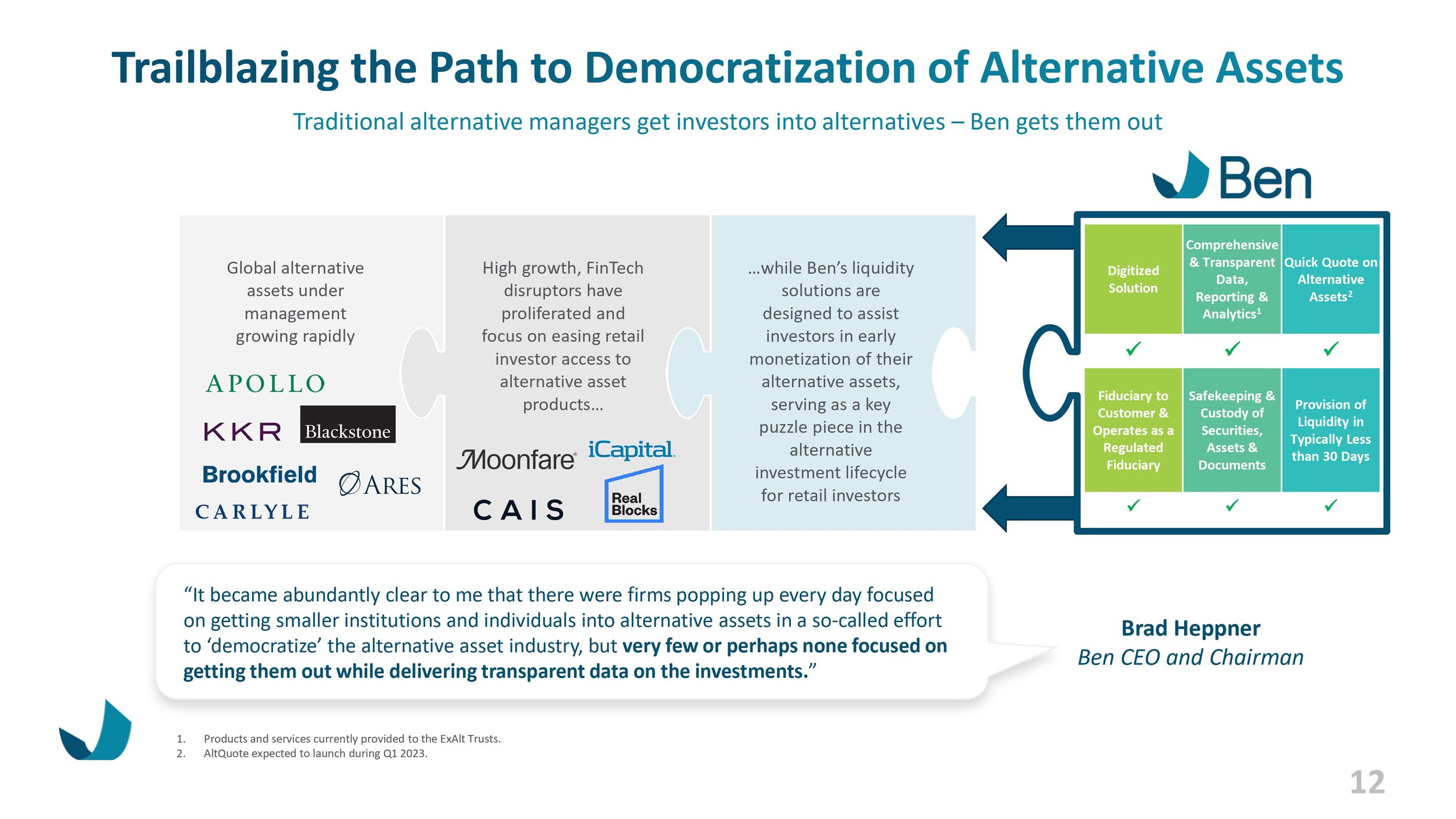

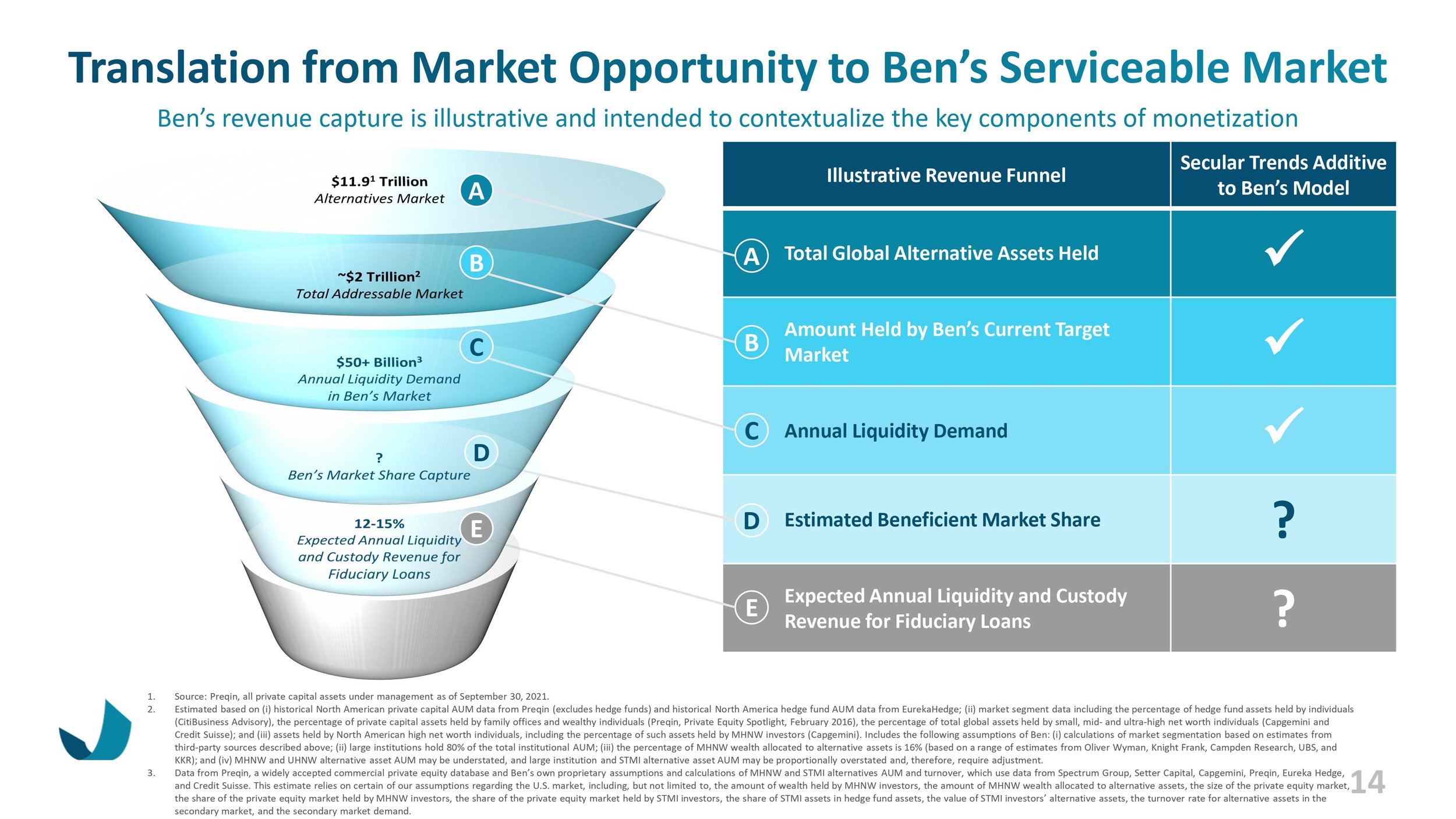

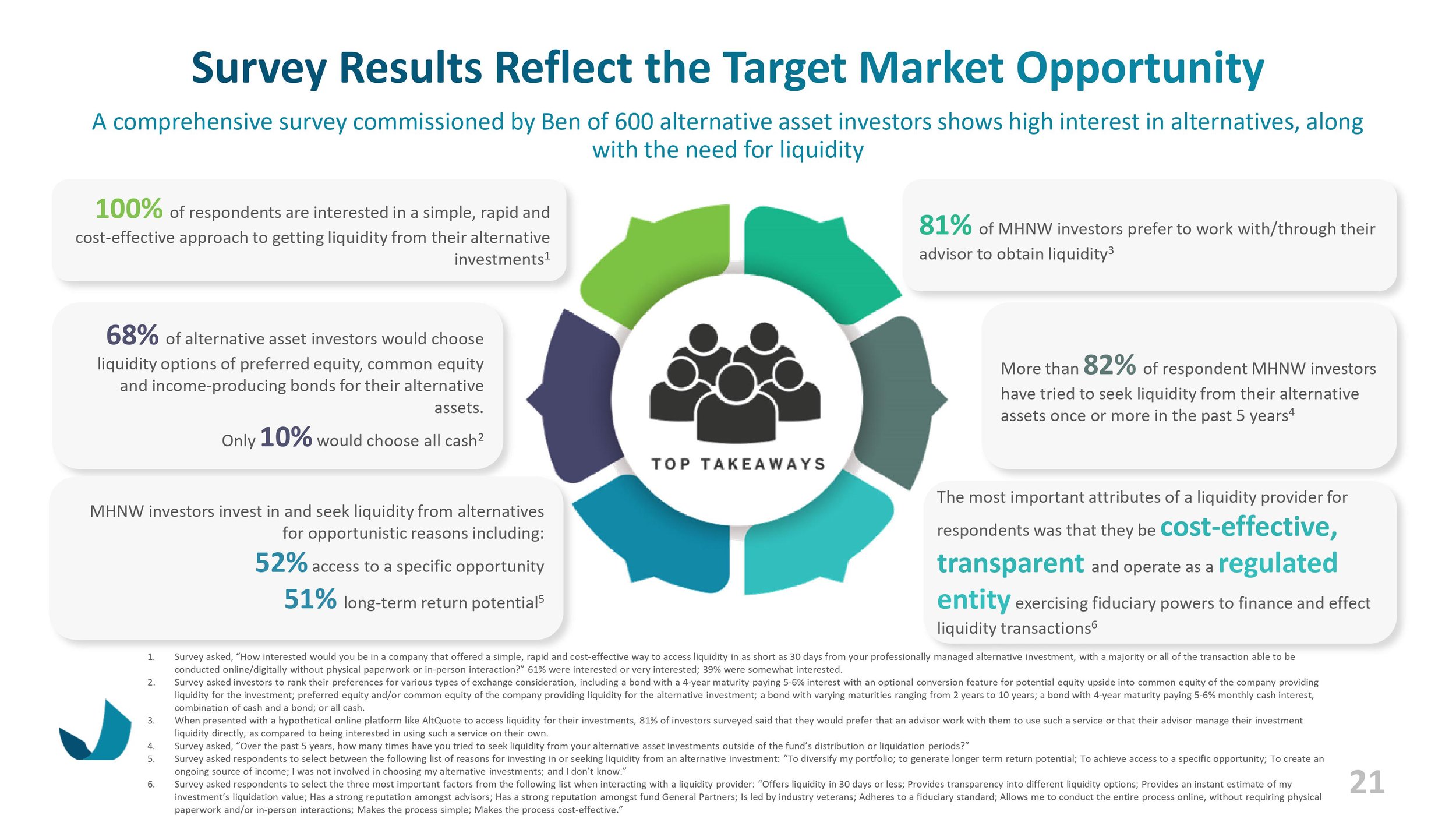

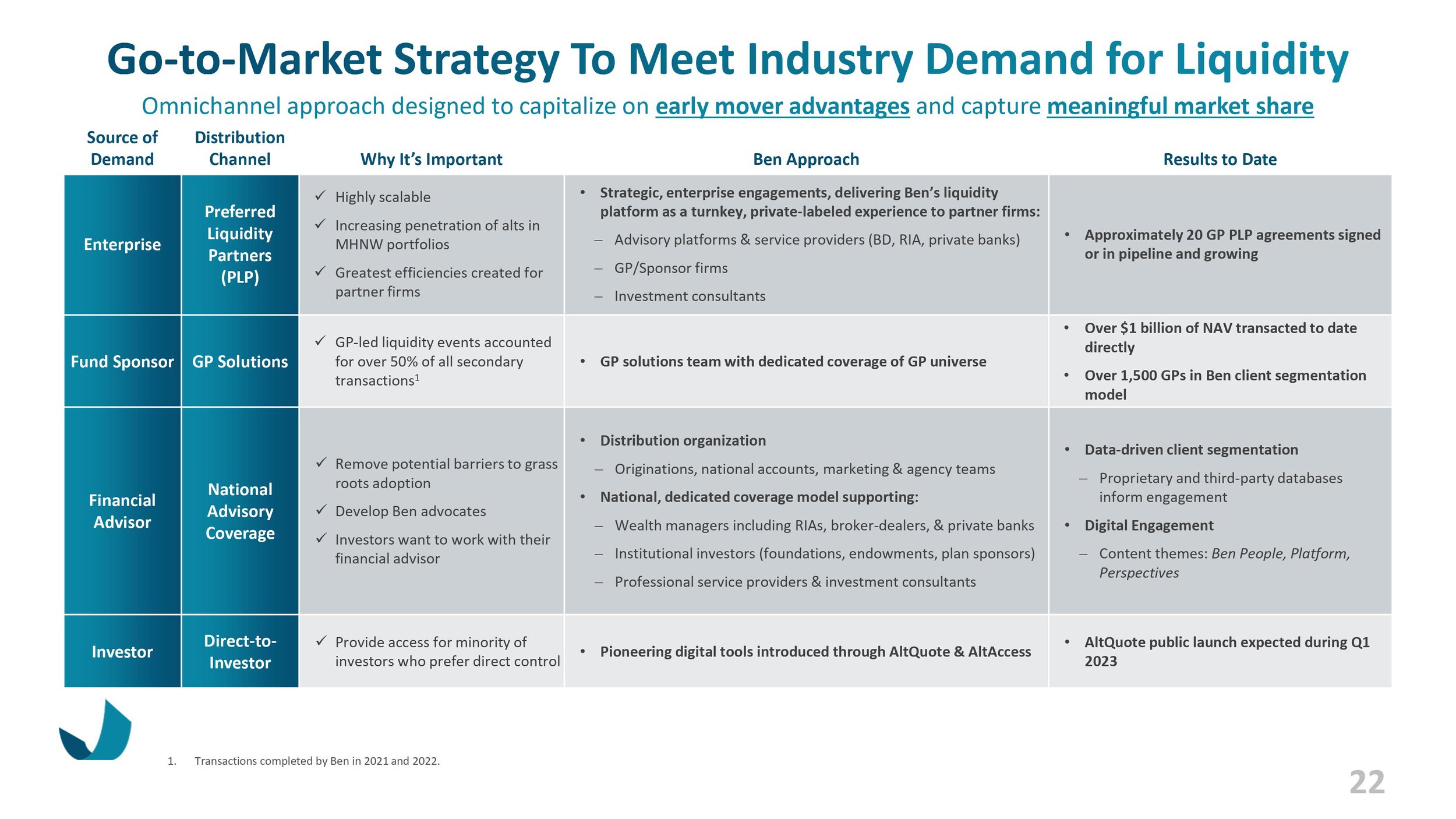

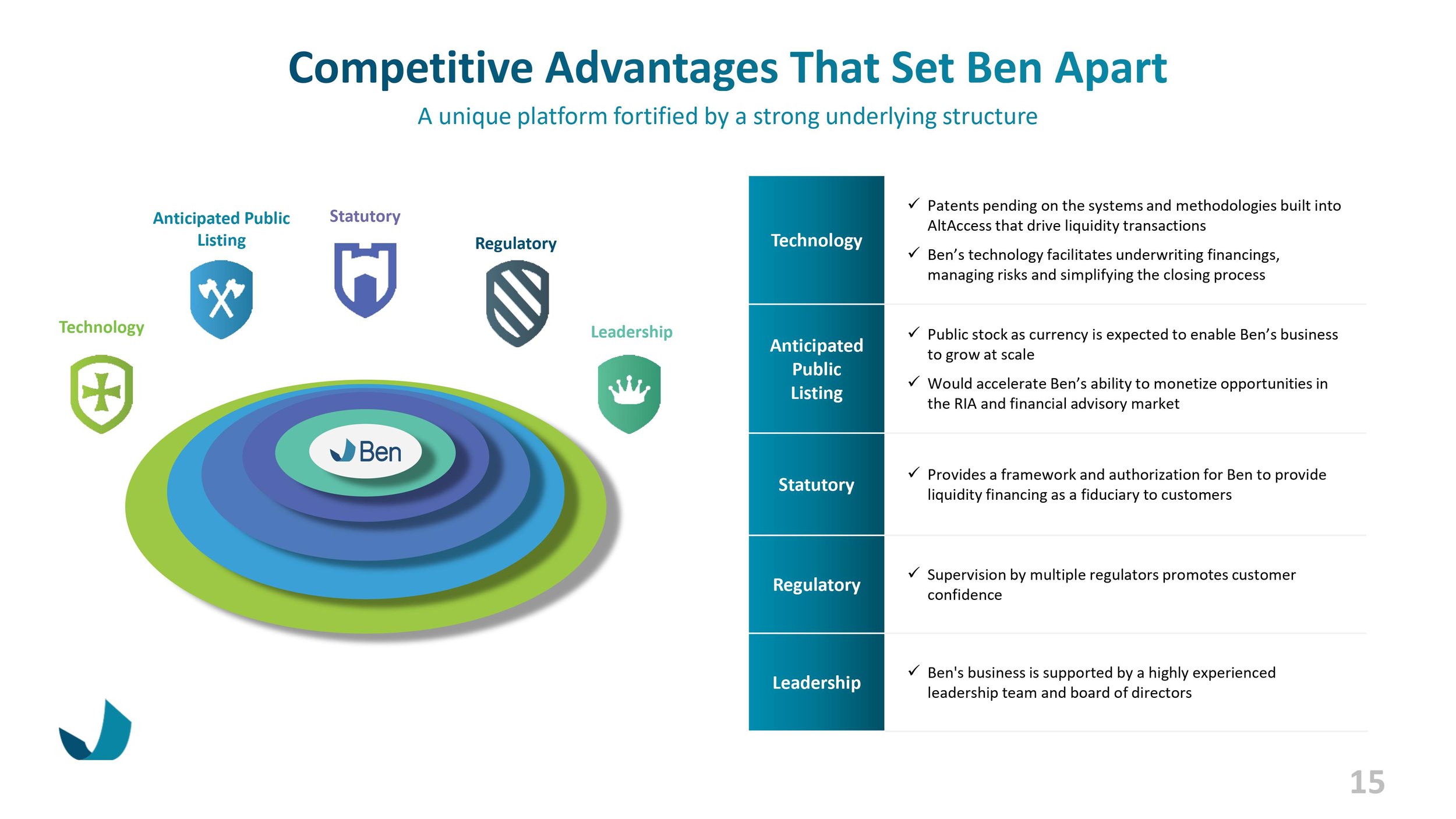

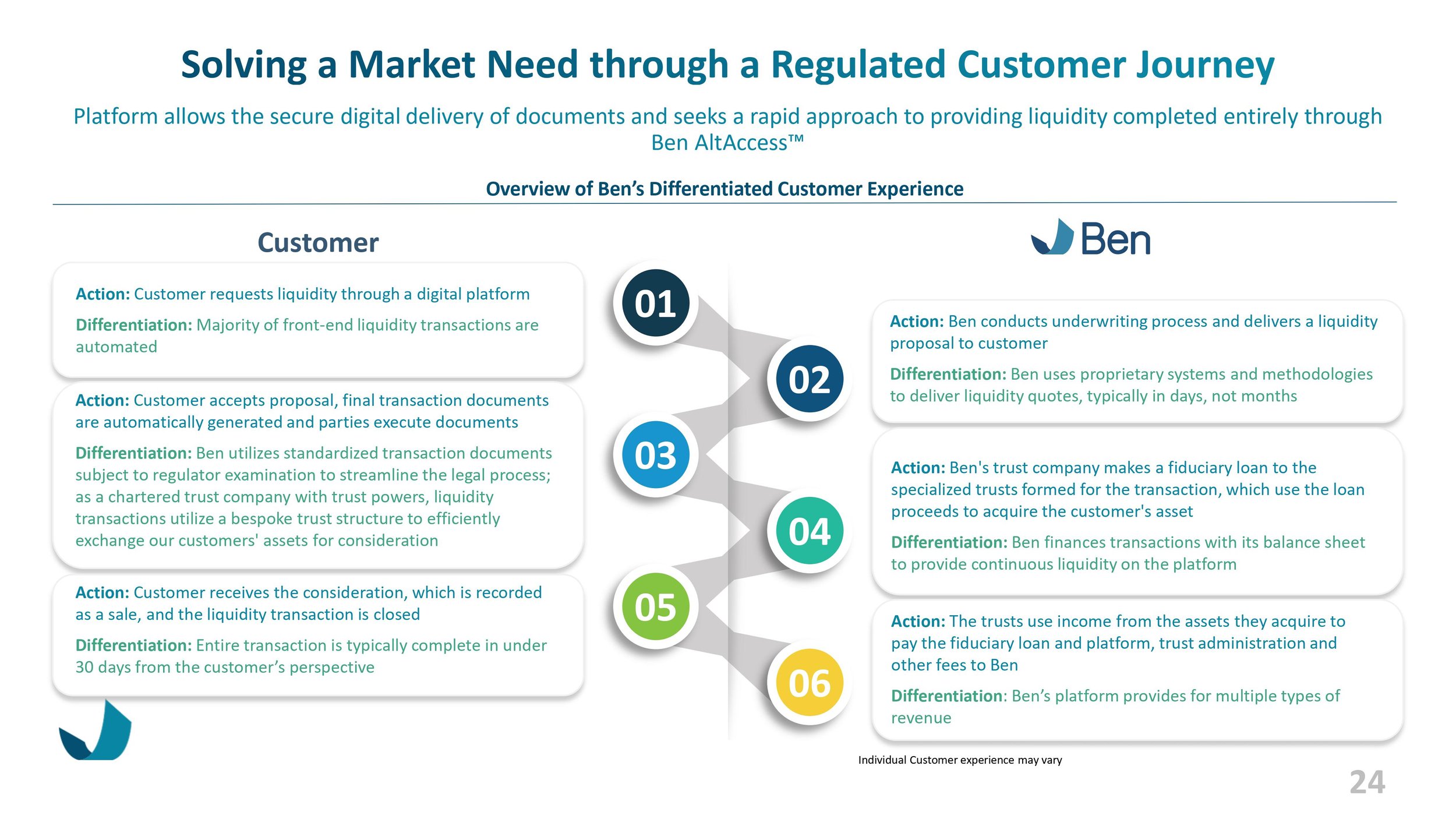

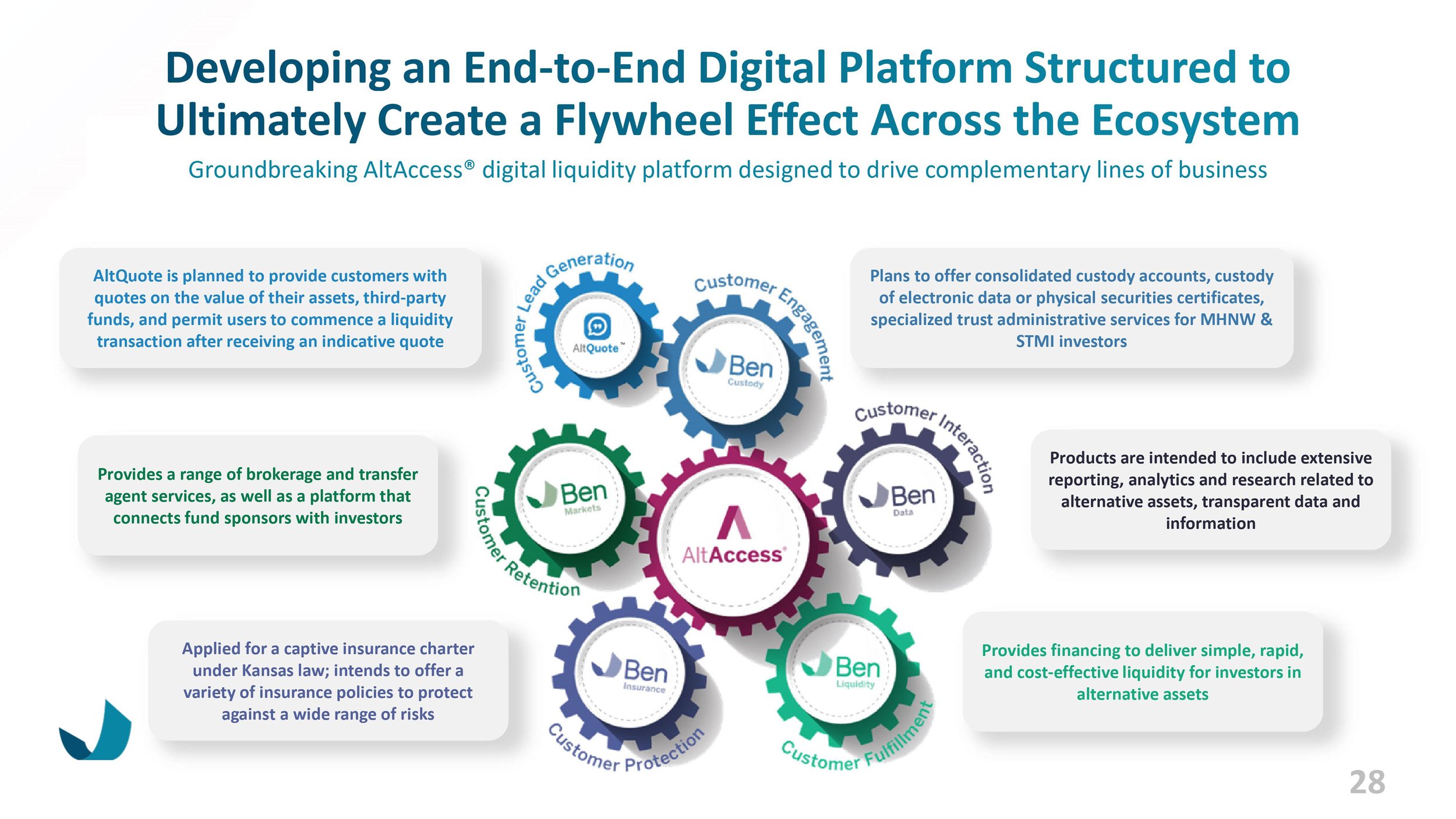

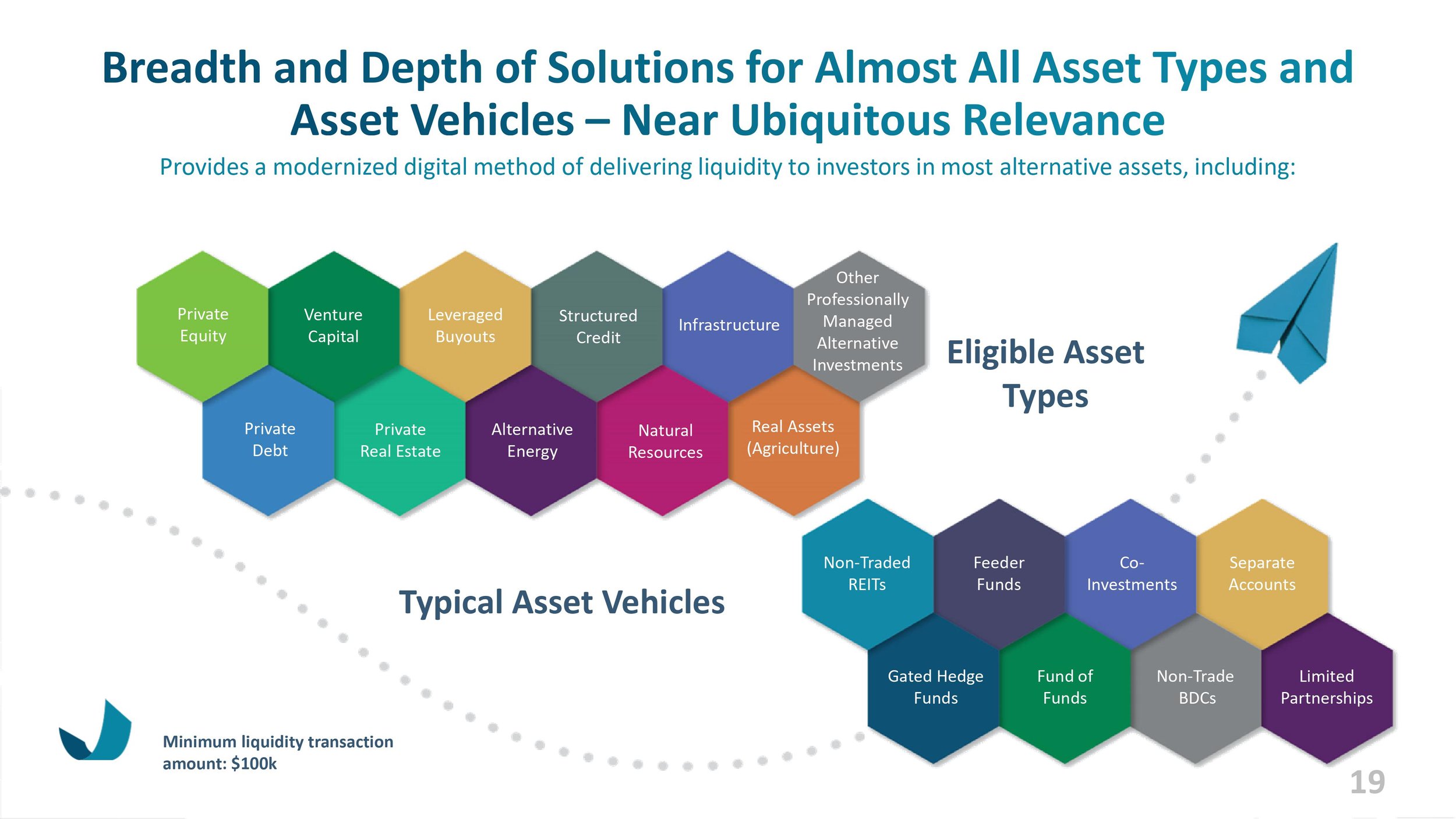

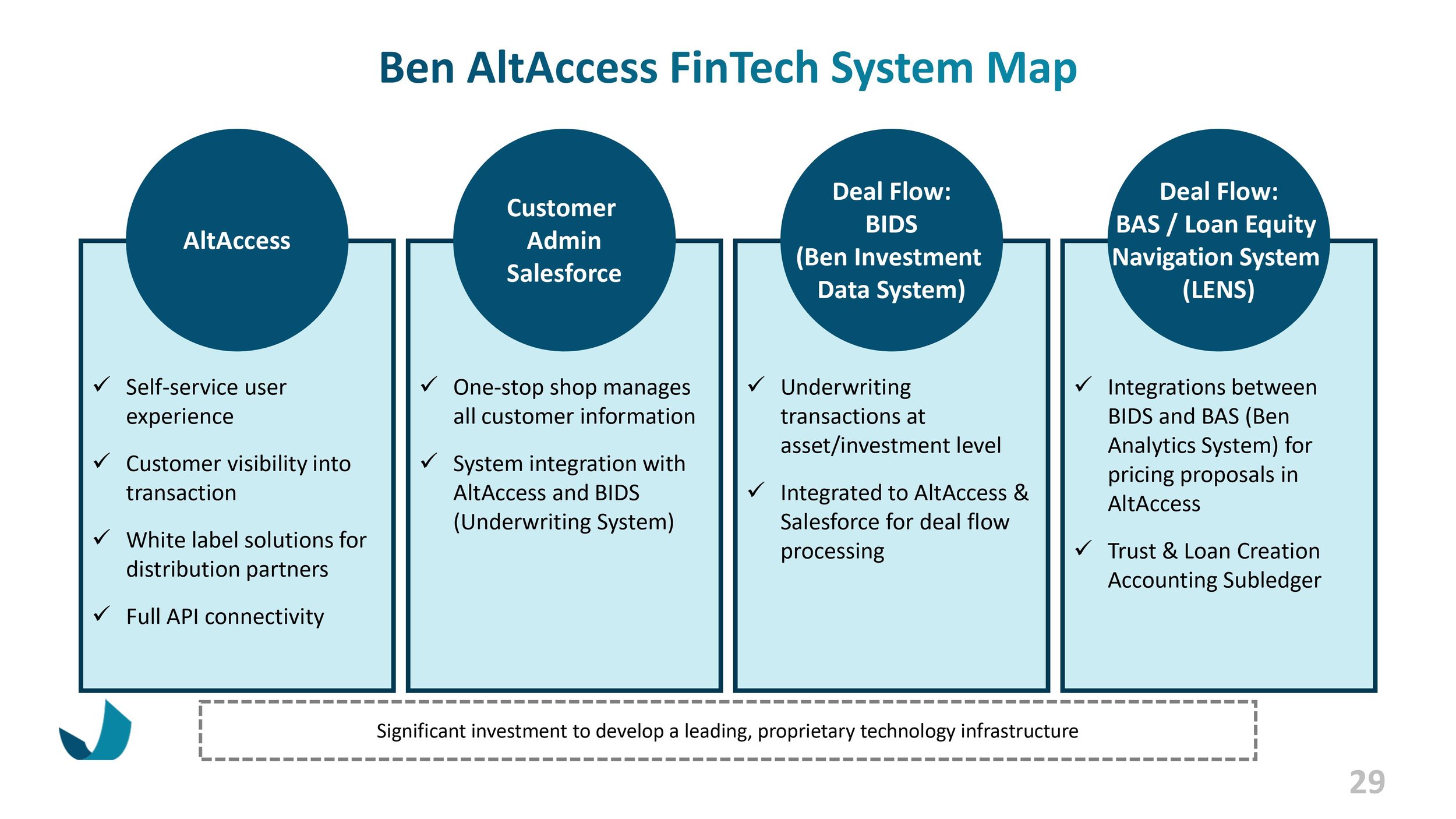

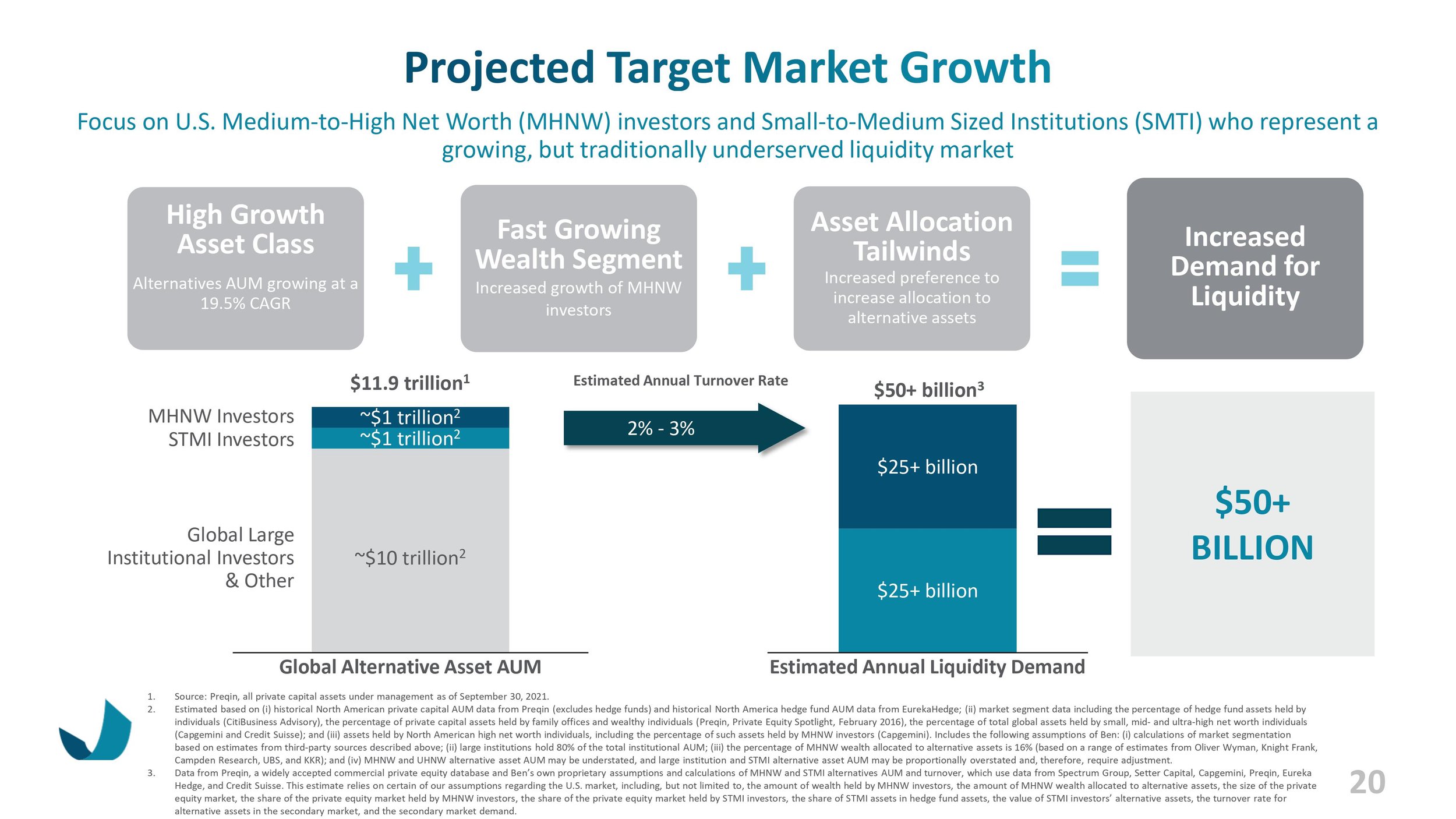

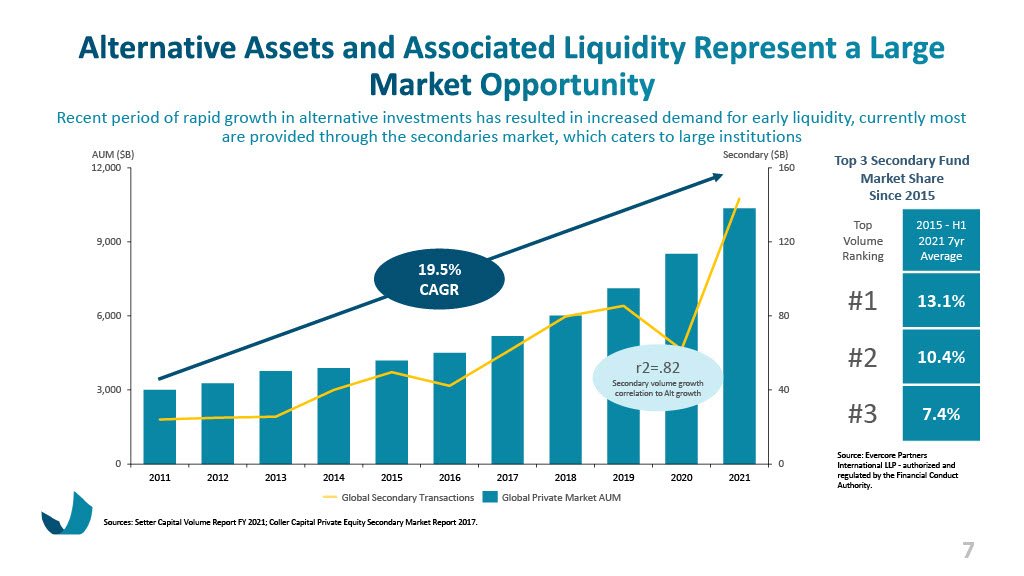

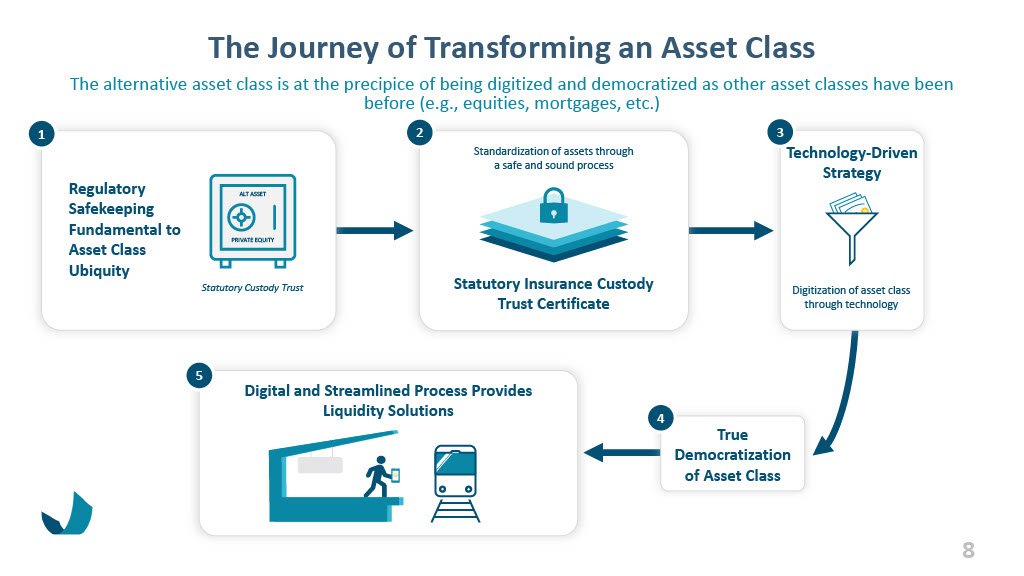

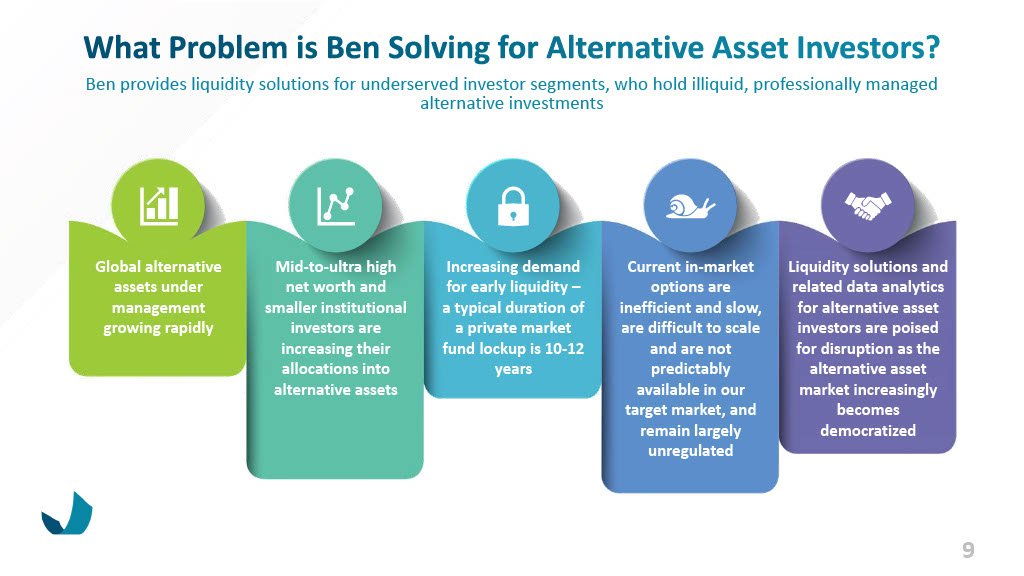

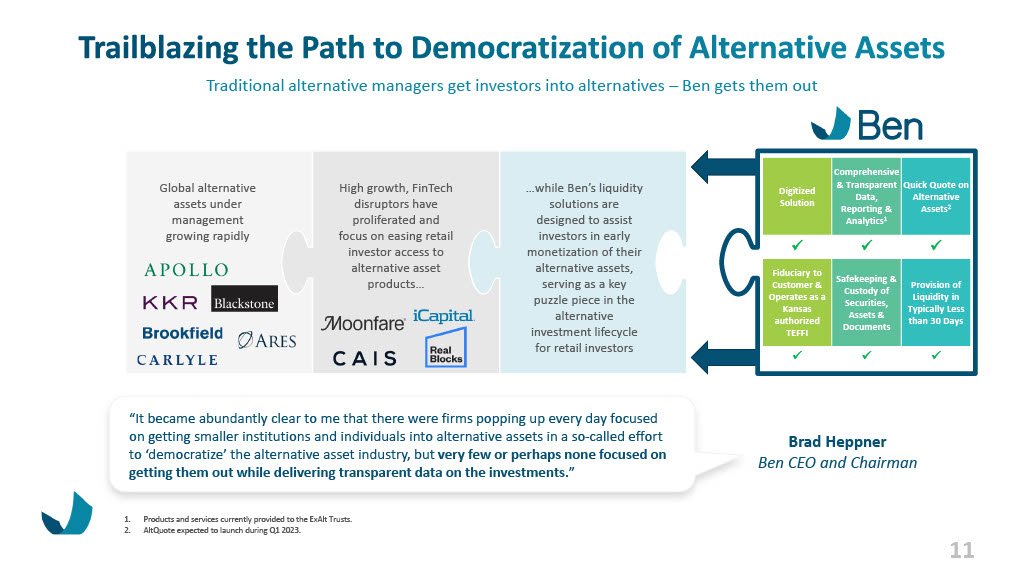

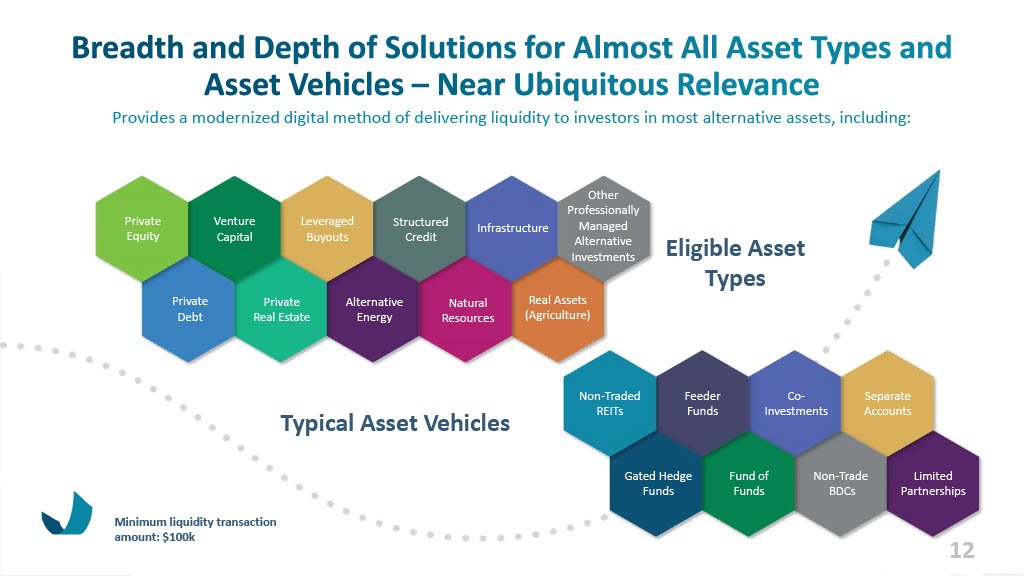

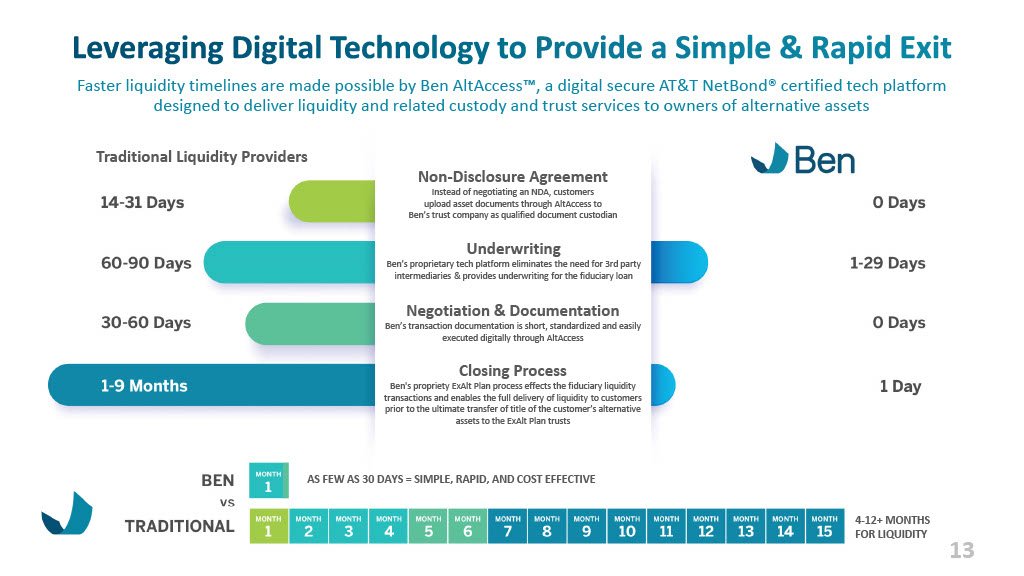

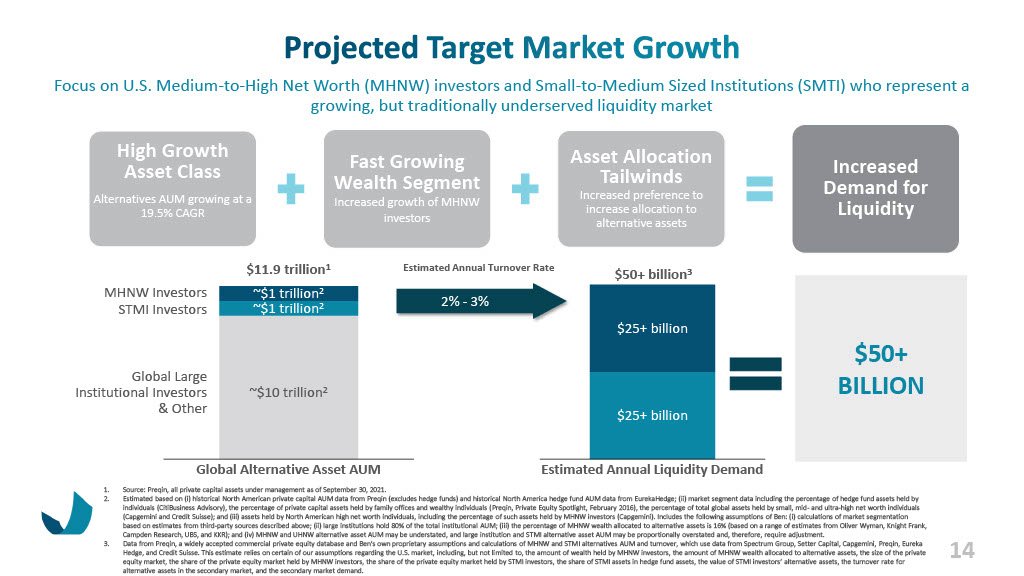

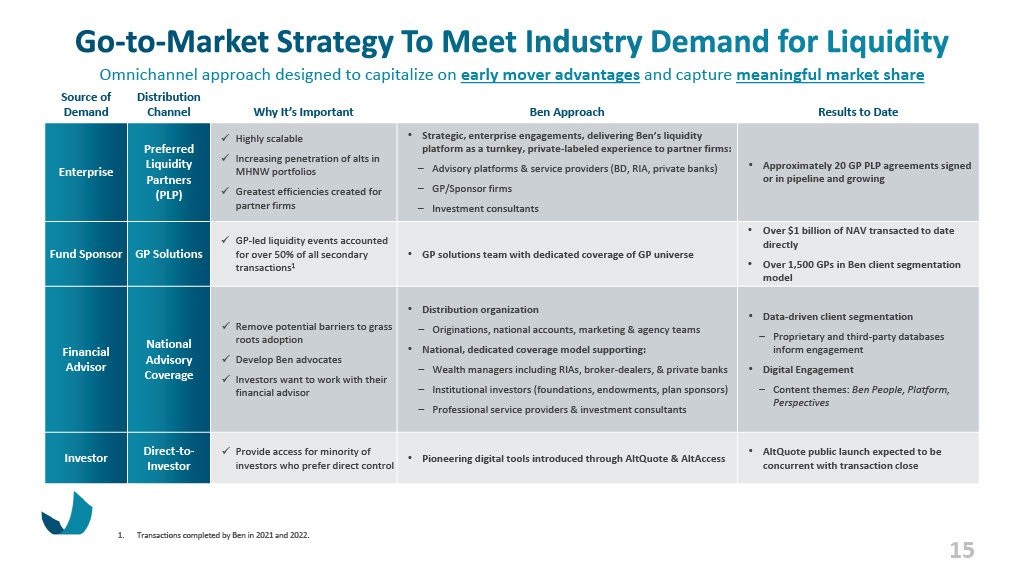

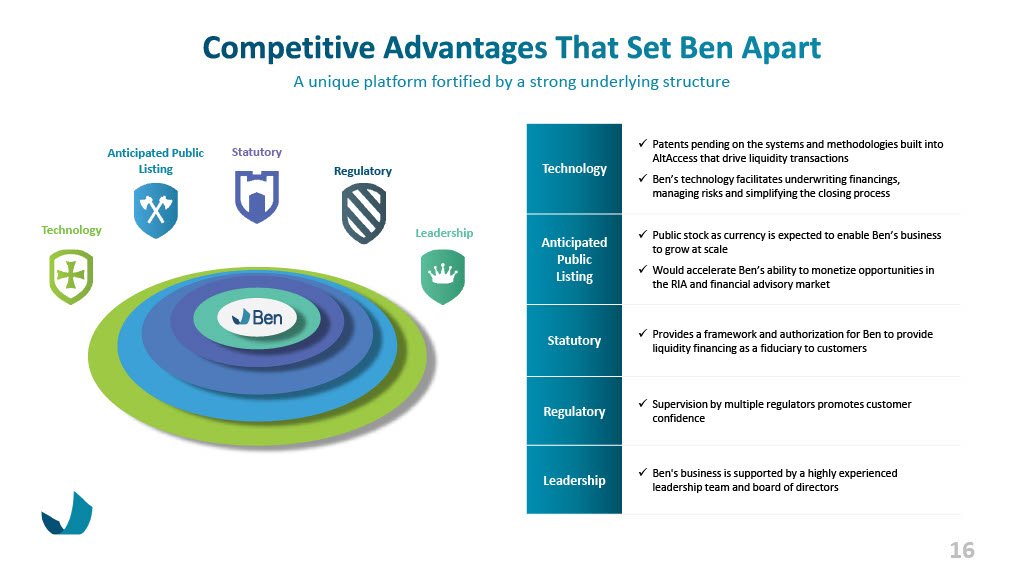

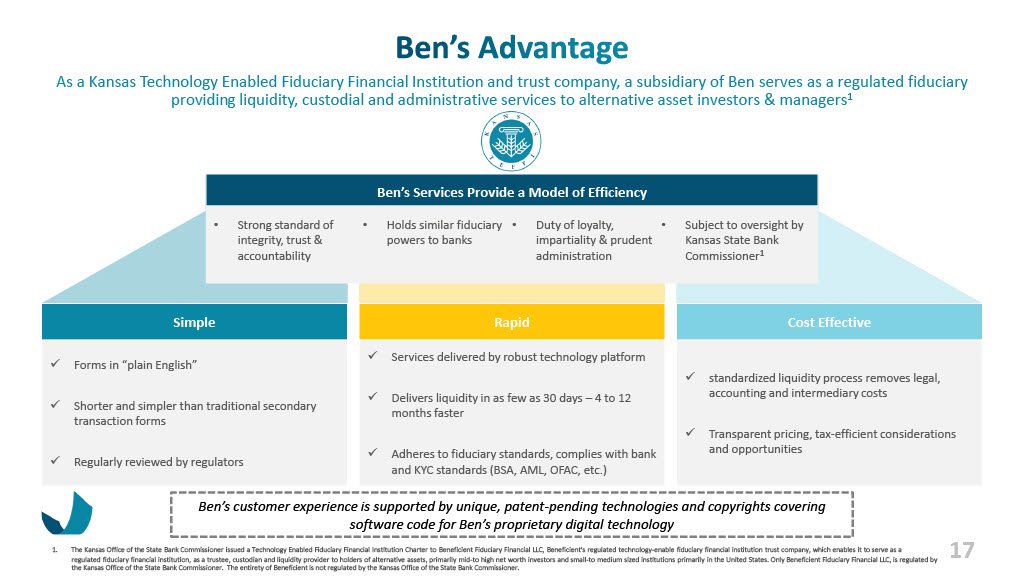

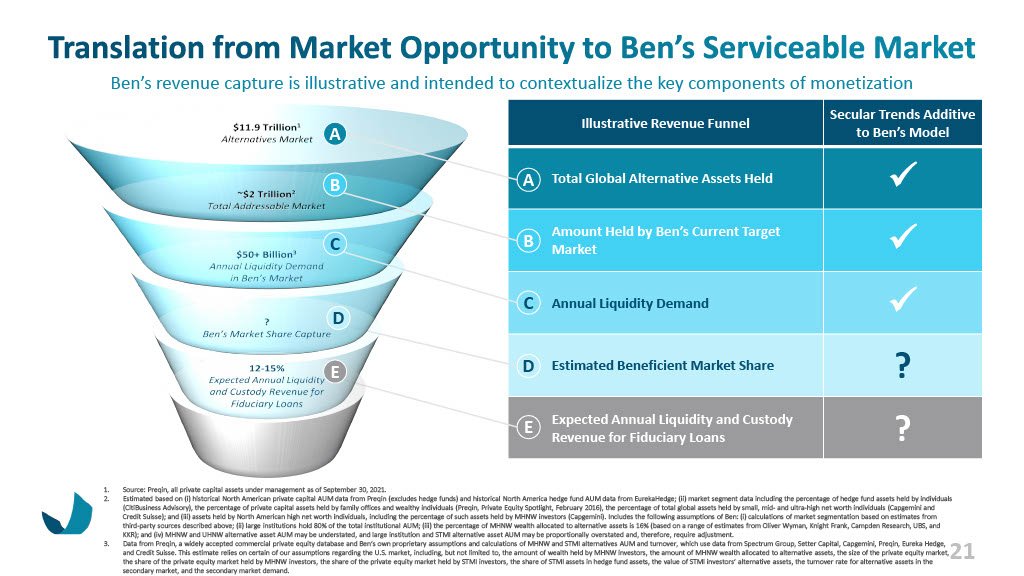

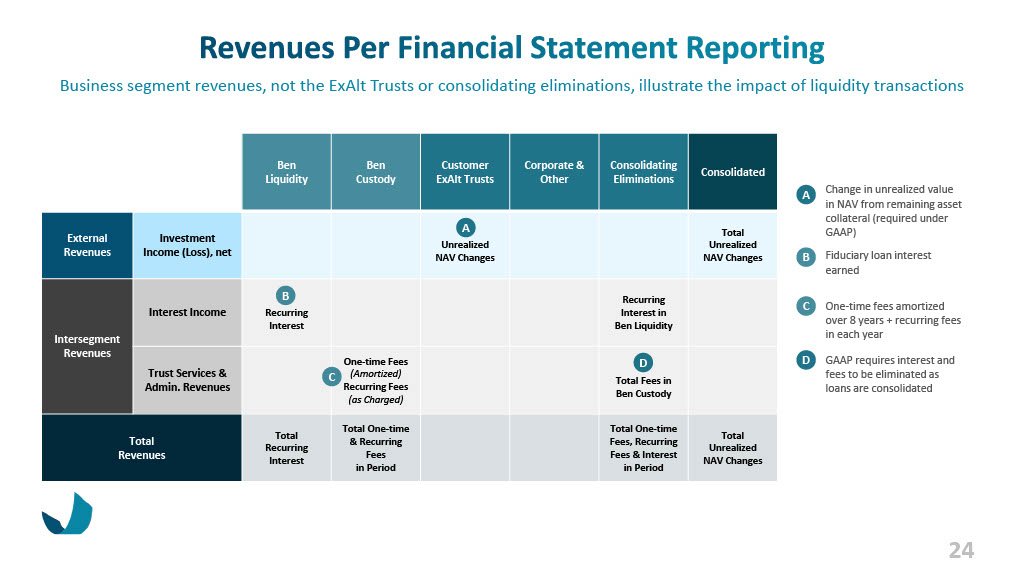

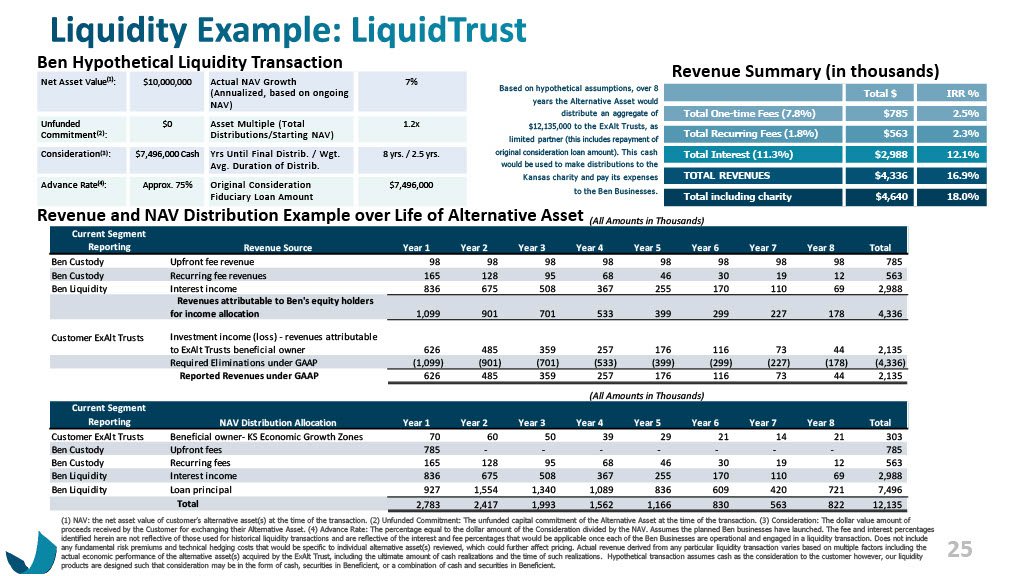

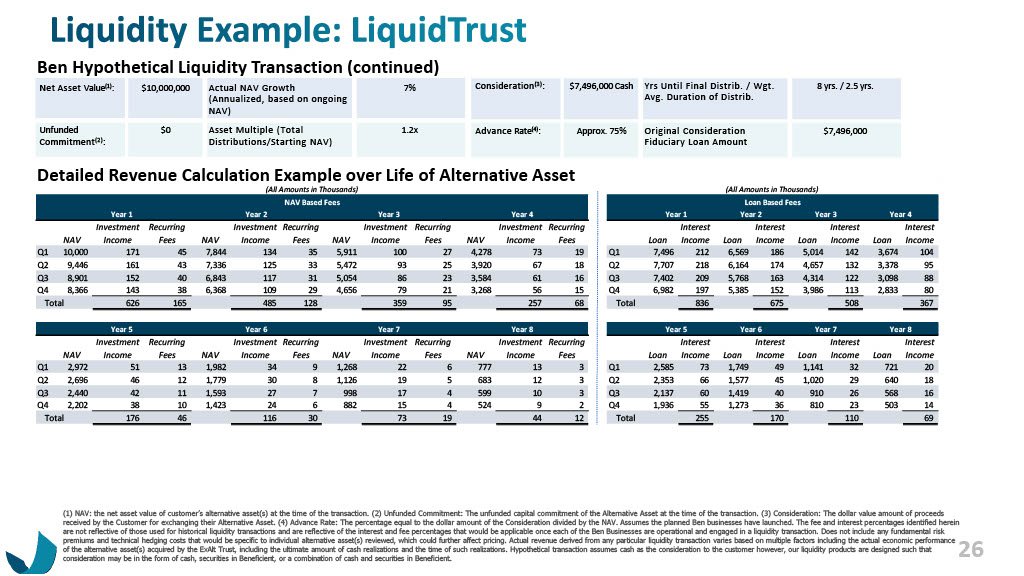

Beneficient is on a mission to democratize the global alternative asset investment market by providing traditionally underserved investors − mid-to-high net worth individuals and small-to-midsized institutions − with early exit solutions that could help them unlock the value in their alternative assets. Ben’s AltQuote™ tool provides customers with a range of potential exit options within minutes, while customers can log on to the AltAccess® portal to explore opportunities and receive proposals in a secure online environment.

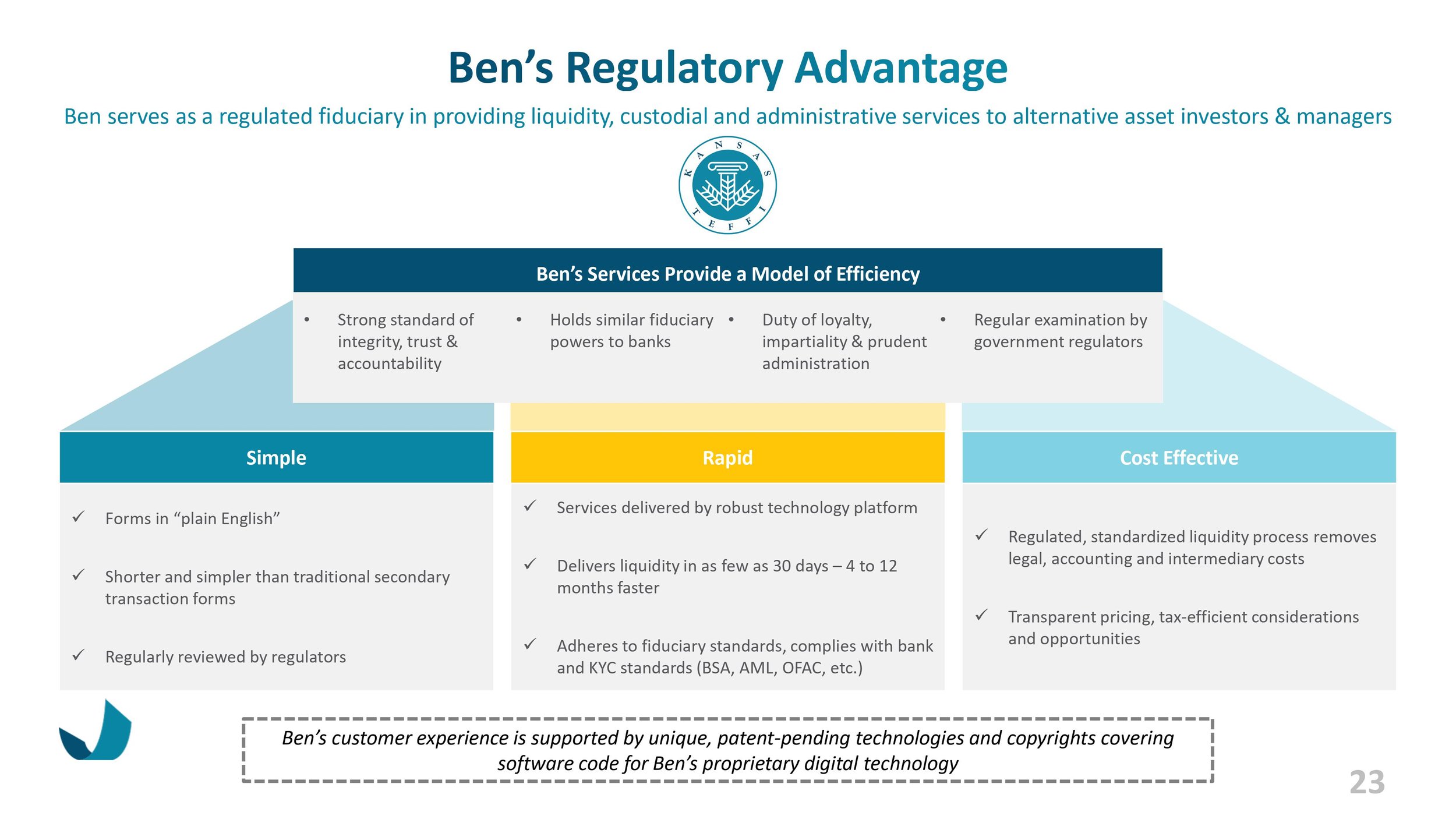

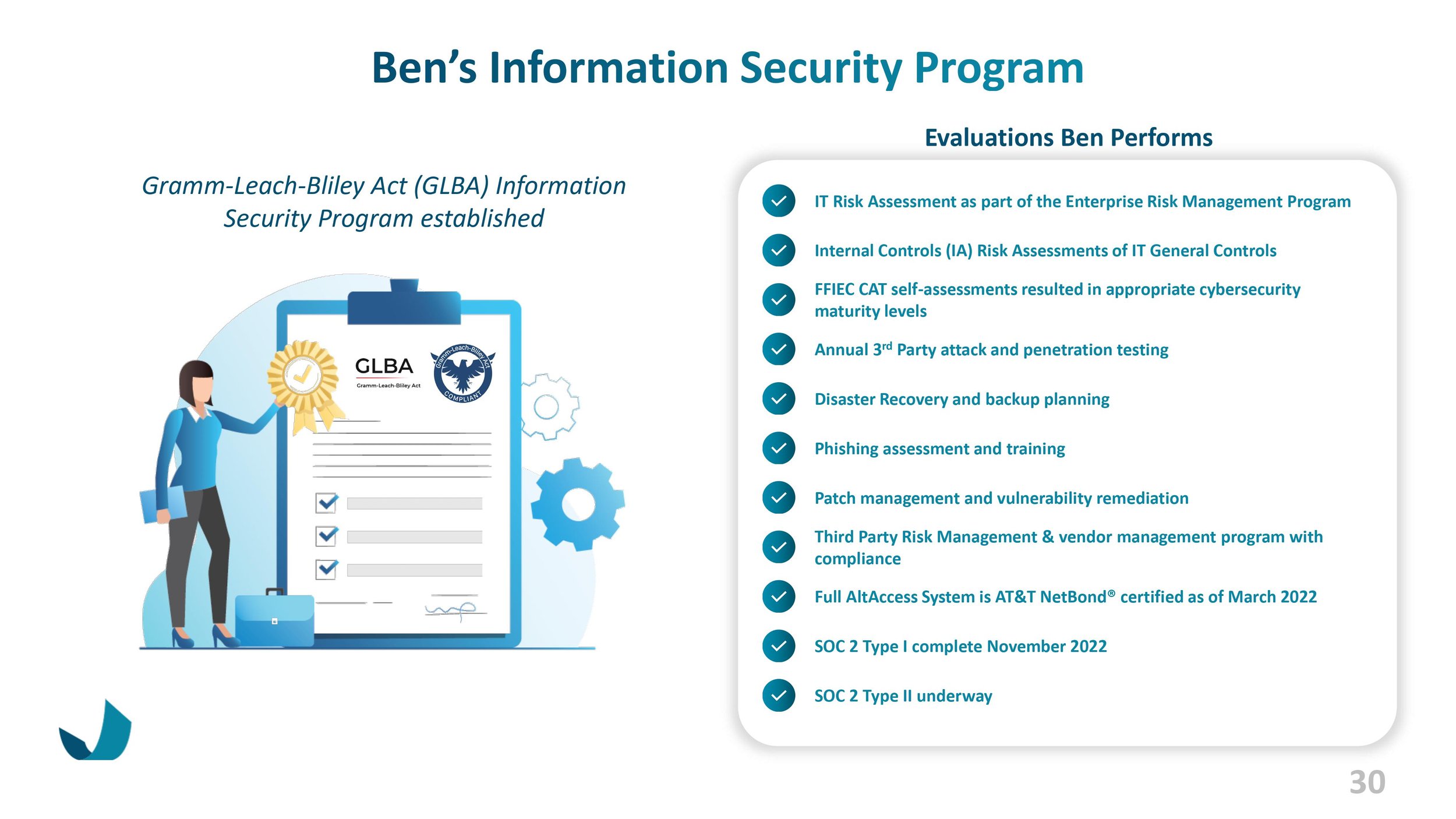

Its subsidiary, Beneficient Fiduciary Financial, L.L.C., received its charter under the State of Kansas’ Technology-Enabled Fiduciary Financial Institution (TEFFI) Act and is subject to regulatory oversight by the Office of the State Bank Commissioner.

For more information, visit www.trustben.com or follow us on LinkedIn.

The Business Combination Proposal has passed at 2023 Special Meeting for Avalon Acquisition Inc.

Click the link below for a replay of the Special Stockholders Meeting.

https://www.cstproxy.com/avalonspac/2023

Avalon Acquisition Inc. Announces Date of Special Meeting for Proposed Business Combination with Beneficient

Avalon Acquisition Inc. (NASDAQ: AVAC) (“Avalon” or the “Company”), a special purpose acquisition company, announced today that it has set June 6, 2023 as the meeting date for the special meeting of stockholders (the “Special Meeting”) to approve the previously announced business combination (the “Business Combination”) with The Beneficient Company Group, L.P. (“Beneficient” or “BCG”) and related proposals.

At the Special Meeting, Avalon’s stockholders will be asked to approve the Business Combination and other such proposals as disclosed in the definitive proxy statement/prospectus (the “Proxy Statement”) relating to the Business Combination. Holders of AVAC Class A common stock and Class B common stock at the close of business on the record date of May 10, 2023 are entitled to notice of the Special Meeting and to vote at the Special Meeting.

The closing of the Business Combination is subject to approval by Avalon’s stockholders and the satisfaction or waiver (as applicable) of other customary closing conditions. If the proposals at the Special Meeting are approved, Avalon anticipates that the business combination will close shortly thereafter, subject to the satisfaction or waiver (as applicable) of all other closing conditions. Upon the closing of the Business Combination, it is expected that Beneficient will be a publicly listed company, and its Class A common stock, Series A convertible preferred stock and warrants are expected to begin trading on the Nasdaq under the symbols BENF, BENFP and BENFW, respectively.

More information about voting and attending the Special Meeting is included in the definitive Proxy Statement filed with the Securities and Exchange Commission (the “SEC”), which is available on the SEC’s website at http://www.sec.gov. Avalon encourages stockholders to read the Proxy Statement carefully. The deadline for Avalon’s public stockholders to exercise their redemption rights in connection with the Business Combination is June 2, 2023 at 5:00 p.m. Eastern Time. If you have any questions or need assistance voting your shares, please contact Avalon’s proxy solicitor, Morrow Sodali LLC, at (800) 662-5200, or banks and brokers can call (203) 658-9400, or by emailing AVAC.info@investor.morrowsodali.com.